Maximize Your Short-Term Rental Income

Tailored Funding Solutions to Help You Succeed in the Vacation Rental Market

Start Earning with

Short-Term Rental Loans

Short-term rental loans are perfect for property investors ready to break into the Airbnb market. These loans focus on the property’s income potential, not your personal finances, making it easier to qualify. With flexible terms and fast approvals, you can quickly turn your property into a profitable vacation rental and start earning more.

Curious If Your Property Is A Good Fit for A Short-Term Rental Loan?

Use our AI powered aiPropNvest tool to make smarter investments. Enter any US property, and it will find the best loan option to help you earn more and reach your goals.

Short-Term Rental Loan Approval Process

01

Submit Your Loan

Provide details about your property and your short-term rental goals, such as expected income and property use.

02

Property Evaluation

We focus on the property’s seasonal or short-term income potential to ensure it meets approval standards.

03

Loan Approval & Closing

Once approved, we’ll help you finalize your loan quickly so you can start earning with your short-term rental.

Key Features of Short-Term Rental Loans

1

No Personal Income Requirement

Approval is based solely on the property’s income, not your personal financials.

2

30-Year Fixed Rate

Lock in a fixed interest rate for long-term stability and predictability.

3

Up to 80% Loan-to-Value (LTV)

Get financing for up to 80% of the property’s value.

4

Loan Amounts from $75,000 to $1.5M

Flexible loan sizes to suit various investment needs.

Short-Term

Rental Loans

Short-term lease loans are the ideal choice for property investors looking to capitalize on the booming vacation rental market. These loans focus on the property’s ability to generate seasonal rental income, rather than your personal financials. With flexible terms and tailored solutions, they make entering the Airbnb and vacation rental market easier.

Advantages:

- Flexible terms suited for seasonal income streams

- Finance up to 80% loan-to-value (LTV)

- No personal income validation required

Best For:

Investors targeting Airbnb or vacation rentals who want to maximize income potential while maintaining financial flexibility.

Investment Loan Options

DSCR Loans

DSCR loans are designed for long-term property investors seeking scalable, predictable financing. These loans focus on the property’s income rather than personal financials, making them a great fit for self-employed or tax-savvy investors.

Advantages:

- Long-term fixed rates (30–40 years)

- No personal income validation required

- Unlimited portfolio growth potential

Best For:

Investors looking to scale their portfolio with stable cash flow.

Comparison to Short-Term Rental Loans:

While DSCR loans offer stability with fixed rates and long terms, they may not be as flexible for properties with seasonal rental income. Short-term lease loans are better suited for investors targeting high-demand, short-term rental markets.

Fix-and-Flip Loans

Fix-and-Flip loans provide short-term financing for property renovations and resales. These loans focus on the property’s after-repair value (ARV), making them a great option for hands-on investors with quick turnaround goals.

Advantages:

- Quick funding for short-term projects

- Designed for fast property renovations and sales

- Based on project value and ARV

Best For:

Investors flipping properties for profit within 12 months.

Comparison to Short-Term Rental Loans:

While Fix-and-Flip loans are project-focused and designed for quick exits, short-term lease loans prioritize rental income, making them ideal for investors building a portfolio of vacation rentals.

Loan Comparison

Choose the financing option that’s right for your investment strategy.

Best for long-term property investors.

DSCR

Loan

Property based approval, not personal income.

Fixed interest rates for 30–40 years.

Scalable, unlimited growth potential.

Minimal documentation required.

Stable, predictable monthly payments.

Best for vacation rental properties

Short-Term Rental Loan

Approval based on seasonal income potential.

Terms vary depending on income consistency.

Moderate interest rates, flexible repayment

Requires proof of market demand and income projections.

Best for short-term project investors.

Fix-and-Flip Loan

Approval based on after-repair value (ARV).

Short terms (12 months)

Higher interest rates, but quick funding.

Ideal for property renovations and resale.

Ready to Maximize Your Investments?

Try the aiPropNvest Tool for Free.

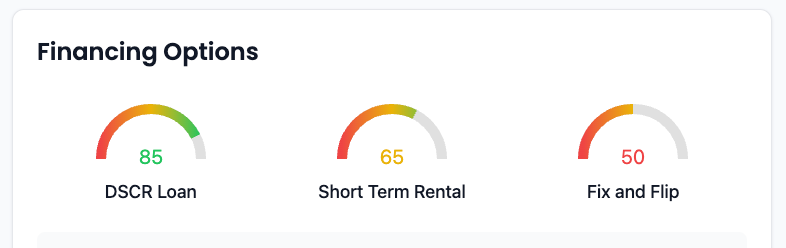

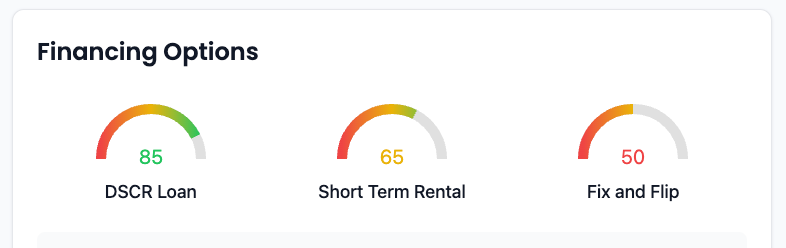

Harness the power of AI with the aiPropNvest tool. Simply input any US residential property into our system, and it will analyze key data to provide a detailed estimate of the best loan option to maximize your returns and align with your investment goals.

Want to setup a meeting with a loan advisor?

Speak with an Expert to Explore Your Loan Options

Disclosures

©2025 All Rights Reserved

Focus DSCR inc. a Focus DSCR registered service mark of Focus DSCR, inc.

Corporate office: Address: 2121 Bethel Rd Suite G, Columbus, Ohio 43220. Equal housing Lender. Some products may not be available in all states. Information, rates, and pricing are subject to change without prior notice at the sole discretion of Focus DSCR, inc. All loan programs are subject to borrowers meeting appropriate underwriting conditions and requirements. This is not a commitment to lend. Focus DSCR only facilities non-owner occupied investment property loans. Other restrictions may apply. Focus DSCR reserves the right to facilitate loans through wholesale, correspondent, and direct programs as it sees fit. For questions, please contact us via phone 614-362-8701.